June 20, 2019

Introducing Vote Analysis

Today we’re launching the first iteration of illumis’ Vote Analysis, a new tool to help with the search and analysis of roll call votes in Congress and at the state-level in each of the 50 state legislatures across the country.

Vote Analysis quickly identifies roll call votes that stand out as abnormal and may warrant further investigation. A lot of existing tools can look up a single vote on a single bill, but Vote Analysis searches across a legislator’s voting history to find instances when a vote stood out.

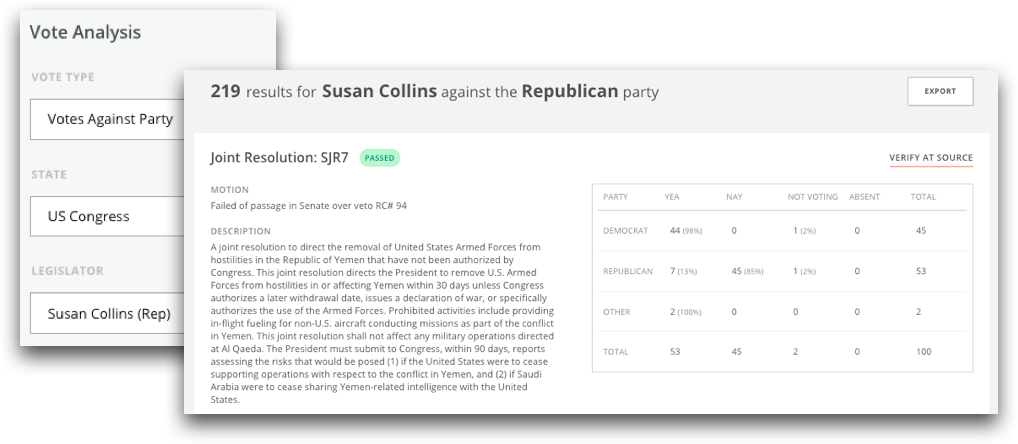

It might be a vote when a legislator broke from their party…

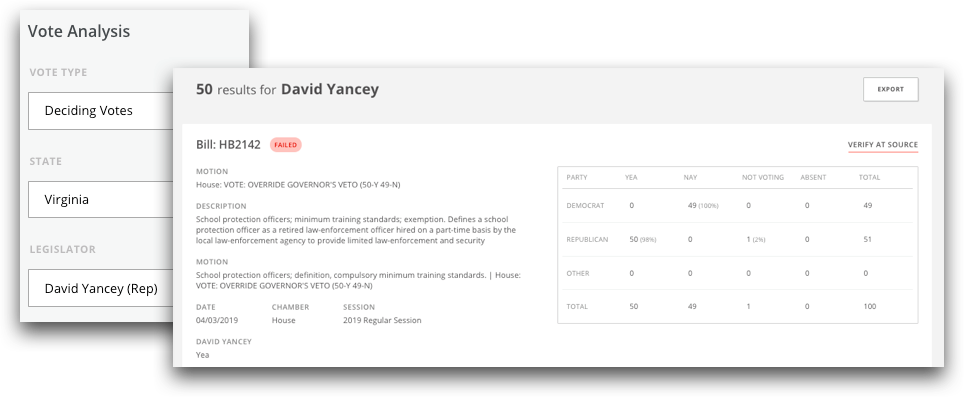

…or it might be a deciding vote on a close bill.

Or it could be a vote that was skipped completely.

Vote Analysis can also identify when a state or federal official voted with or against another legislator and pick out when a lawmaker was the only person to vote a certain way.

Often times, abnormal or odd votes can tie in with other information available on illumis. A yes vote might coincide with a campaign donation or activity reported by a lobbyist. Or an odd vote a few years ago may have new significance in light of recent adverse events. The context surrounding these votes can have huge implications and Vote Analysis makes it easy to quickly find the roll calls that might matter most.

Vote Analysis is now available as part of illumis’ Search platform. You can get in touch with solutions@illumis.com to request a demo or to learn more.

Please Note: This post was updated in June 2020 to reflect our company’s new name: illumis

.png?width=1263&height=519&name=COMPLY-illumis_DRK%20(1).png)